#2 Feb 11, '24: Plover Bay

Router & software specialist: nearly 8% dividend yield & double-digit revenue growth

This is just a brief summary, please refer to the PowerPoint deck below for full details.

60-page PowerPoint Deck (click image below to download):

3-statement financial model (click image below to download):

Remember the first time when you connected to a Wi-Fi - did you marvel at the technology of how it was possible to connect to the Internet without even a wire?

We certainly did - and also recall plugging in an Ethernet connection at the same time, hoping that by connecting to both the Wi-Fi and the wired connection that the download speeds would increase.

Well, it was not to be.

But the company we dive into today can do exactly that, and allow you to take advantage of multiple connections.

Plover Bay is an HK-based specialist, focused on providing SD-WAN (Software-defined Wide Area Network) integrated router and software solutions under the Peplink brand.

Nearly 8% dividend yield combined with double-digit expected forward revenue growth and a reasonable 12.6× P/E makes it a very interesting play, especially when combined with the likes of the Starlink catalyst and general 5G tailwind.

Plover Bay’s core differentiator is its SpeedFusion technology, which improves the speed and reliability by fully utilizing all available connections, providing several key benefits, including:

Bandwidth bonding. This is Peplink-specific terminology (the more common term being link bonding), but allows you to use the available bandwidth through all available connections.

Hot failover. If you lose your primary connection, e.g., in the middle of a Zoom call, it will automatically switch over to a backup connection, without dropping the call.

These features are especially attractive for enterprise and business users, who favor Peplink’s reliability. Consequently, they are able to charge premium prices, with blended gross margins of over 52%.

In our view, Plover Bay enjoys two major moats

Technology moat. SpeedFusion, in particular, is protected by numerous patents, with one of the earliest only lapsing in 2029. The technology, coupled with Peplink’s wireless prowess, brings critical differentiation vs the broader SD-WAN market

Ecosystem moat. Peplink has built a strong, active community with a strong brand reputation, thanks to its focus on product quality. Furthermore, Plover Bay has a global network of over 100 reseller partners spread in more than 60 countries

The team has focused on building quality products rather than marketing, especially using the community to spread word of the product. This has resulted helped create superior unit economics & SG&A expense ratios especially versus competitors of comparable size.

Because of the technical nature of its products and services, as well as its relative isolation in HK (most of its competitors are based in the US) it has so far remained independent - which is why we have direct access, even though the sector is highly acquisitive, and almost all niche players have been gobbled up by bigger players.

That said, the acquisition of its most direct competitor Cradlepoint by Ericsson does also spell challenges. Clear cross-selling and land-and-expand plays will become possible.

Furthermore, Plover Bay’s main capability gap lies in its cybersecurity, which has basic functionality but lacks some of the more advanced unified threat management (UTM) and firewall features present in some enterprise SD-WAN competitors. These are now frequently sold in bundles (within what is called the SASE framework), with Gartner, the technology research firm, predicting that the majority of SD-WAN solutions will be sold in SASE bundles in the future.

However, Plover Bay has decided to position itself differently and focus on the wireless SD-WAN segment in particular. Going forward, it will need to decide on a suitable SASE strategy, whether to develop cybersecurity capabilities in-house, or find go-to-market partners to offer the entire suite of functionality.

What the market has overlooked

Starlink catalyst. Starlink had more than 2 million users by the end of 2023, and is still growing rapidly, but suffers at times from unreliable connections and congestion. Peplink products can help address this directly with SpeedFusion, and so Peplink has become the authorized technology provider for Starlink - enabling its resellers to also distribute Starlink’s $2500 terminal (the more expensive model). A couple of weeks ago, Starlink initiated a major promotional push into ships and planes - key growth areas for Peplink - yet the market reaction almost did not react at all.

Rate cut catalyst. We show in our analysis that Peplink / Plover Bay has been much more sensitive to interest rates than either the S&P 500 or the Hang Seng Index. Consequently, if rates fall, Plover Bay share prices may undergo significant upward repricing.

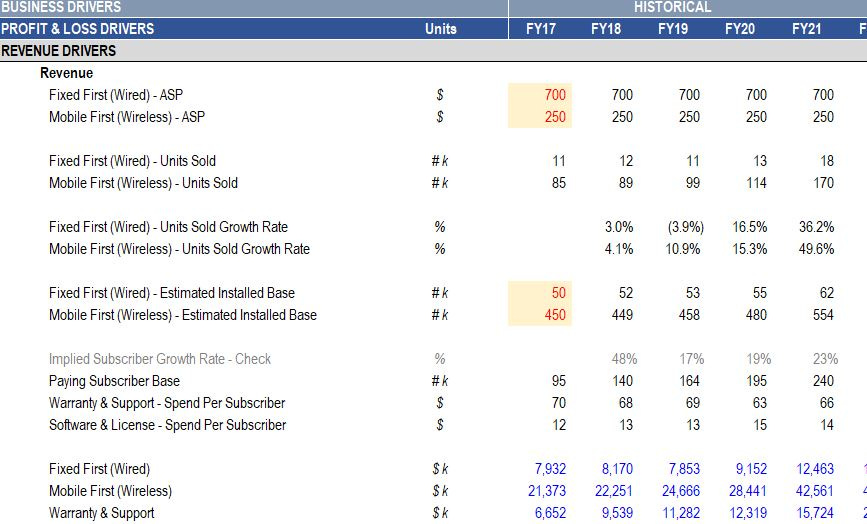

Shift to software. Plover Bay is no longer a hardware pureplay - by 2022 half its gross profits came from software and not hardware. Notably, in the past couple of years, gross margins have deteriorated. However, through modeling we find that because software sales are driven by the installed base, Plover Bay has the option to reduce hardware prices and profit instead through the much higher margin software & services segment.

Thesis

•Offers growth & income. 18% TTM revenues growth (10-12% expected going forward), solid dividend yield close to 8%, well-covered by strong cashflow with 186× interest rate coverage.

•Good valuation, strong ROE. 12.6× P/E with 18% YoY sales growth, 60% ROE (contrast with vs Cisco at ~16× P/E and 11% YoY sales growth, and Fortinet at over 40 × P/E and 20% YoY sales growth).

•Focused niche. #1 player & most premium brand in Wireless SD-WAN niche, with almost all other niche players having been acquired.

•Product-driven mindset. Puts product ahead of marketing, using community to advocate products - driving superior unit economics.

•Tech & community moats. Patented SpeedFusion tech driving reliability for enterprises & helped create fans for community.

Full disclosure: We hold a long position in Plover Bay. We have no business relationship with companies whose stock is mentioned in this note, and are not paid to write this piece (other than paying fellow exponents of the research).

Disclaimer: This should not be construed as investment advice. Please do your own research or consult an independent financial advisor. Alpha Exponent is not a licensed investment advisor; any assertions in these articles are the opinions of the contributors

Hi, it seems like the 60-page PowerPoint Deck is no longer available?

Thanks I was looking in the company and found it very useful.