Why care about investing (hint: compounding)

How investment income can exceed a full-time salary, and the issue with risk and market efficiency as taught at school.

Depending on the stage and style of education, capital markets and stocks in particular tend to be variously:

Ignored completely.

Viewed as the world’s greatest casino - OK, maybe not completely off.

Seen as a sociological manifestation of pure randomness (or Brownian noise for the quantitatively-minded).

The first view leads to a lamentable lack of financial literacy among even among a surprising number of otherwise perfectly well-educated people, which we believe actually elevates the risk of having inadequate wealth accumulated.

The second view is as regrettable as the first (don’t gamble with your savings, since the house always wins).

Meanwhile the third view tends to lead to a type of shorthand definition by analogy.

While well-intended and handy for practioners, statistical measures can lead to many users confusing the map for the terrain - just look at what happened to p-values, or VaR (it helped to variously lead to the LCTM crash and 2008 crisis).

Stock markets are kind of random, so … let’s define volatility as risk!

Here’s what Mr Taleb, well-known for his writings on risk and contrarian investing strategies has to say about the matter:

Volatility is not the same as risk; and the more you think it is, the more vulnerable you are to the Black Swan.

— Nassim Nicolas Taleb

Luckily we have been to places where black swans (of the avian variety) are even more common than their fellow fair-feathered friends, so we discovered a related corollary - that supposedly-rare events tend to come in clusters. But we digress.

It should be said that volatility, when used correctly, is not a poor risk proxy, but one of the best. That is why the Sharpe Ratio (excess returns versus per unit volatility) is considered the gold standard in the industry. More on that in future posts.

Isn’t it investing risky though?

We have a different, longer-term view of risk. Volatility is less relevant for those:

Who do not use leverage.

Who still have much of their lives ahead of them.

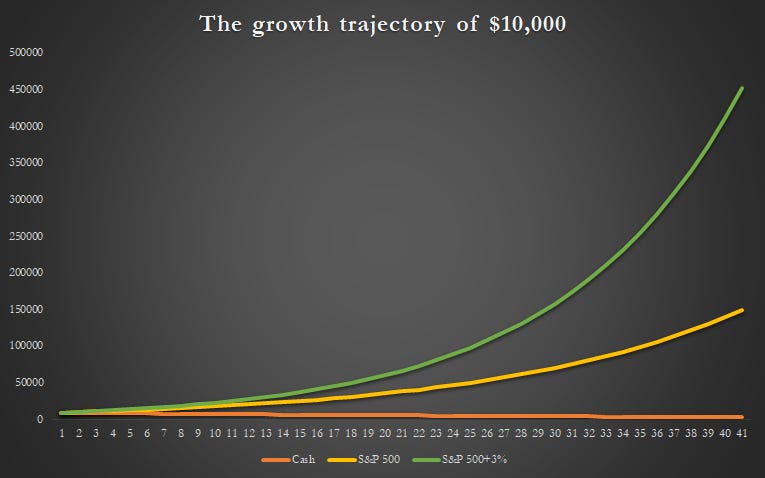

The chart below shows the growth trajectory of $10,000 over a 40-year career:

Source: Active Alpha Research

Here are the amounts you end up with in real, inflation-adjusted terms:

Cash assuming 2.5% inflation: $3,724 (over 60% loss!)

S&P 500 assuming annualised growth 7% higher than inflation: $149,745

S&P 500 + annualised 3% outperformance: $452,593

These are estimates based on long-term averages. Note that sitting in cash almost guarantees a more than 50% loss in real terms. Sound risky?

Casting the time horizon out longer, every currency in history have either fallen to zero value, or been drastically devalued.

But don’t take our word for it. Here’s what Ray Dalio, founder of macro hedge fund Bridgewater has to say on the matter.

Think about holding currencies (which is the same as holding cash) in the same way as you would think about holding any other assets. How would you have done in these investments?

Of the roughly 750 currencies that have existed since 1700, only about 20% remain, and of those that remain all have been devalued.

— Ray Dalio

80% chance of total loss, and 20% chance of (drastic) devaluation. Sounds risky.

Meanwhile, a retail investor who bought the S&P 500 and sat on it will have an almost 15× gain and have beat the market, outperforming most professional investors - 50% of these underperform versus the average before fees, and more than 50% post-fees.

Meanwhile, an annualised 3% outperformance over the S&P 500 will leave you with more than 3× versus the S&P 500, and over 100× versus cash.

Split evenly over the 40 years, the gains alone will be than the $10,000 principal, every year. That’s more than $10,000 extra every year, after inflation.

How can anyone afford to not be thinking about investing?

What if you have just begun working full-time recently?

You may or may not have a huge amount to start with, but lucky you. Compounding is more powerful the younger you start.

Invest well, and there is a good chance that you’ll earn more from your investments than from your full-time job, over a 40-year career.

Check out the back test below. It is one of our favourite resources for a quick backtest (see other resources here) - you can also try any asset allocation yourself.

The technique used below is called dollar cost averaging (DCA), where you start with $1000, and invest $1000 every month for the past 40 years.

DCA reduces the risk that you buy at too high a price in the one go, essentially offering diversification over time.

Source: Portfolio Visualizer

The numbers are all inflation-adjusted, with portfolio 1 (blue line) investing in all large-caps like the S&P 500, versus portfolio 2 (red line) all 10-year treasuries.

Portfolio 2 is not bad. Over the entire period you will have contributed in total $1000+40×12×$1000 = $481k (actually less in inflation-adjusted terms), but you’ll end up with a balance of $0.75 million adjusting for inflation ($2.37 million unadjusted).

With portfolio 1, you’ll finish with an inflation-adjusted balance of $3.13 million (or $9.86 million unadjusted).

Subtract out $481k in contributions - we are conservatively over-subtracting here, since these have not been adjusted down for inflation - and the net gains would be $2.65M. Split over the 40 years gives you a little over $66k per year.

According to Federal Reserve Economic Data (FRED) median personal income was just over $40k per year.

This was possible thanks to the powers of compounding, passive investing and DCA.

And what if we aspire to the Alpha Exponent and outperform the market over the long run? After all, that is why we are here.

The Efficient Market Paradox

You will need to be an active investor to outperform the market for long stretches (or get extremely lucky). Some prominent academics, such as the Nobel Economics Award winner Eugene Fama, postulate that it is not even possible.

“The proposition is that prices reflect all available information, which in simple terms means since prices reflect all available information, there's no way to beat the market.”

— Eugene Fama

As the joke goes, an economics student and his professor are strolling down a street, when the student spots a Franklin on the ground, and says, "Hey, there's a $100 bill!"

The economics professor snorts, "Outrageous! What did I just teach you? If there’s a $100 bill, someone else would’ve already picked it up!"

Is it certain that you will beat the market year after year? No one can guarantee that.

But we do believe in the merits of sound investment principles, and helping you find your edge. Finding good value investments is one of our investment tenets.

In some sense, all investing is value investing - we have yet to see anyone get rich from selling securities for less than what they paid for them.

It’s excellent news for active investors that folks believe that active investment is an exercise in futility, since this leaves more untapped value, and improves our chances.

The paradox is that market efficiency is driven by constant arbitrage, without which markets would cease to be efficient altogether.

Disclaimer: This should not be construed as investment advice. Please do your own research or consult an independent financial advisor. Alpha Exponent is not a licensed investment advisor; any assertions in these articles are the opinions of the contributors.