Delta #3 2024: how good are Reddit value investors at finding value?

The wisdom of crowds in action

Can a group of value-investing enthusiasts in aggregate on Reddit beat the market? We take an admittedly unscientific look.

Some time ago, we posted on Reddit an interesting question:

As it turns out the top 5 rated comments were:

I. With 12 votes - u/d*****v:

Sectors: Financials (specifically banks), and to a lesser degree, Energy

Geos: Europe and UK, and to a lesser degree, China

I think European banks will be the top performing combo over the next few years.

Edit: Why?

On the geography level:

Europe and UK have by far the best valuation metrics. Except China, none of the other geographies are even remotely close.

They have been in recession or nearly in recession for a while now. Buy during the recession.

Sector:

There is no reason banks shouldn't be trading at similar multiples to the rest of the market. The multiples are much lower based on the market's predictions of future earnings. I don't believe the market can forecast future earnings with much accuracy and seek to oppose it.

The book values are superb and I do believe low book values, on a sector level, indicate greater long term returns.

We are talking p/es of 6-8x and p/b of 0.8. They're not just a little better but massively better. Example ETF

These are major institutions, essential to the economy. Provided they comply with the capital requirements (they do), the regulator/central bank will have to help them out if needed (if it is even needed, it might not be)

The low rate environment has been killing them (in Europe rates were zero-negative for a very long time). We are out of that environment for now, pushing up revenue, and once we get that yield curve uninverted, profitability should be very strong.

Honestly, the charts. Just look at BNP, SAN, HSBA, BARC etc on the weekly/monthly charts and tell me they don't look like they're turning. Also, appreciate how much upside there is. The risk-reward is very, very good.

Dividend yield very good. Even if the price doesn't grow I like getting paid 5% to hold

There are other little reasons which I can't think of right now.

II. With 10 votes - u/S*****e:

Shares in British companies are at a phenomenal value at the moment. It’s why so many have been snapped up by American firms

III. With 9 votes - u/I*****r:

my macro thesis is that tech will continue to advance, alternative energy sources will take longer than people think and traditional energy will continue to be used as energy demand climbs, climate change will create food and water shortages. homes need to be built to address housing issue.

so semiconductors and other required tech, oil and gas, consumer staples, residential construction.

i like india over china, US over everyone.

IV. With 8 votes - u/T*****o:

Oil?

Equal V. With 7 votes - u/R*****6:

Global IT Infrastructure Services. The companies in this industry have gotten slaughtered as the broader trend has been customers switching to the cloud from physical on-premise IT. This has caused lower revenue and an aggressive pricing environment as IT companies compete for less business. But as the age-old saying goes the cure for low prices is low prices. On-premise IT is still necessary and there are signs that the cloud migration trend is slowly starting to end. The surviving IT companies should thus be in a position to maintain their earnings which is good because many of them are priced like they'll be going out of business in the not-to-distant future. The riskiest and my favorite is DXC Technology. Kyndryl (The IBM spinoff) is probably more appealing and if you want to be more cautious then look at the Indian ADR's Infosys, Wipro, Cognizant, Tech Mahindra, etc. A smarter investor than me probably would create a fully diversified portfolio of these companies.

Equal V. With 7 Votes - u/N*****4:

In the United States. Utilities, Real estate and Energy, they trade at a discount compared to other sectors. Consumer staples will be the next to decline after we get poor guidance and lowered future estimates.

Sector wise Japan may have picked up but still trading at a value if you’re willing to hold for years. Buffet added more money to his Japanese positions as well as he sees it as a 10+ year hold.

China can be seen as value , but the bottom hasn’t happened yet , and they’ll only continue to shoot themselves in the foot. If Trump is reelected then China will have a crazy rebound so it’s a hit or miss. Either way it’s a hold, and a sell especially factoring in Buffet sold BYD. He had a 3 percent stake left, but he doesn’t have to disclose if he sells it now. This is the same way Munger and Li Lu exited.

I like the European market as a whole since the companies with ADR’s trade as being undervalued. France however makes you pay a tax when buying or selling securities unfortunately. But you do get some great companies in France as well as all of Europe at discounts.

Canada is a nice pick for energy at this time. If you’re looking for anything else maybe wait till the banks reports earnings in Canada.

Other emerging markets are a gamble but if you like it I would go with an ETF like DIEM. Low expense fee(%0.19), high dividend yield(%4.43) and covers China, Taiwan, South Korea, Australia, Latin America and the Middle East.

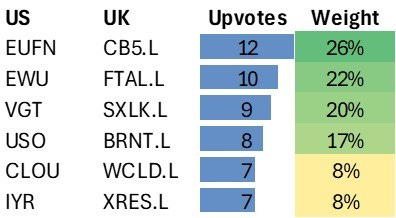

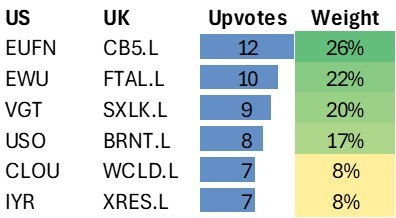

So according to our simple methodology, we shall make a simulated index based on the top 5 answers (we see two answers tied for fifth), weighting them by number of upvotes.

Also we aim to keep everything in the same currency to make the accounting simple.

European banks. OK, so something like EUFN (European financials) to kick us off. The CB5. L (Amundi MSCI Europe Banks) for UK or European investors.

United Kingdom. Let’s go with EWU (iShares MSCI United Kingdom ETF) for this one. The UK-listed equivalent would be FTAL.L (SPDR UK All Share).

US Tech. Right, so multiple sectors in the US were mentioned, but tech seems to have been the first one, so let’s opt for VGT for the US. SXLK.L (SPDR Technology Select) would be a UK-listed alternative.

Oil ETF. Keeping it simple - the USO (US Oil Fund) would be the US-listed option, and BRNT.L (WisdomTreet Brent Crude Oil) the UK option.

Global IT Infra. That sounds a lot like cloud technology, so CLOU (Global X Cloud Computing ETF) it shall be. WCLD.L (WT Cloud Computing) for the UK-listed alternative.

US Real Estate. The other joint 5th mentions some of the same exposures as 3, so we shall go with US Real Estate, and choose IYR (iShares U.S. Real Estate ETF) . The UK-listed XRES.L (Invesco Real Estate S&P US Select Sector) will be our other option here.

After some quick number-crunching, the weights shall be:

We shall track the evolution from the start of 2024 to the end of the year. While this may often be data snooping (we already finished January, we are not too concerned about it in our particular case, given that this particular index ended down some 0.2% for the first month.

Let’s see how it performs vs the S&P 500 over the course of the year.