Q2 2024 portfolio review

The wins, losses and updates on GigaCloud, Newborn Town and more

As we enter the second half of the year, it is time to review and reflect on the portfolio performance to date. So far, it has been a very good year, returning 36.69% versus the 15.13% of the S&P 500.

We use the total return index of the S&P 500 as shown below since it is the gold standard against which portfolios are generally assessed, despite our particular portfolio having little overlap with it (returns correlation is only 0.35).

The ground rules

(Almost) zero leverage. To be kept below 5% at all times.

15% maximum initial position size. No holding limit though - positions can exceed 15% if stock prices appreciate.

Side bets to be kept under 4%. Side bets here are defined as any that have not been through the full-multiweek due diligence process.

Concentrated bets. No more than 20 positions in the portfolio simultaneously.

Long-term horizon. Deep-dive stocks are intended to be solid enough to be held for 10 years - though may be sold much sooner, and we do look for catalysts before buying in. Side-bets are relatively short-term holdings intended to be held less than a year.

Key mistakes and learnings

Discretionary pain. We shall discuss this at more length, but our consumer discretionary trades, especially in LH Group, turned out to be quite a drag on performance.

Being slow on the entry. Waiting completing the full due diligence to enter Newborn Town turned out to be a slight mistake. At HK $1.8 it was clearly undervalued, yet by the time we made the first purchase it was over $2.1; in such situations it appears more prudent to take Druckenmiller’s advice to start with a small position before scaling in as the study is completed.

I start with a small position to get my feet wet, and then as my confidence grows, I add to it.

-Stanley Druckenmiller

Too many side bets. We finished the period with over 20 positions, and this should ideally be trimmed down to 10-15. This is partially due to the point above, which can easily loosen discipline if not appropriately constrained by process.

I like putting all my eggs in one basket and then watching the eggs very carefully.

-Stanley Druckenmiller

The wrong calls

Fortunately we have not been punished too badly so far by Mr. Market for any transgressions.

The top two losses were similar, stemming bets in the consumer discretionary sector that met with adverse macro conditions that ran counter to what we expected.

This type of mistake we have made twice now in the portfolio, and would be difficult to altogether avoid in the future, so our aim is instead to try to minimize such losses when they do occur.

Ironically our macro bet (recovery of Chinese tourism) was broadly correct, yet our logical deduction was wrong. We have described the post-mortem previously, but here is a summary again for convenience.

Japan has maintained low rates both due to its debt burden (to keep down interest payments), and attempt at stimulating economic activity.

The US dollar is strong, so the HK dollar is strong due to the currency peg, making it cheap for more affluent Hong Kongers to travel to Japan.

This resulted in high-end Japanese restaurants discounting, in turn taking patrons away from the likes of the mid-end Gyukaku, LH’s main income stream.

The strong HK dollar versus the Chinese Yuan is causing lots of Hong Kongers are crossing the border to Shenzhen on the weekends to buy cheaper groceries and dine in the restaurants there.

Meanwhile, dining vouchers notwithstanding, PRC tourists have been favoring cheaper restaurants in HK. For more expensive restaurants, they preferred those not available in mainland China.

Unfortunately, a couple of Gyukakus have also set up shop in Shenzhen right before the pandemic (LH Group only operates those in HK).

This meant that Gyukaku had to discount to remain competitive. Since the chain was LH’s Group’s main workhorse, this hit their earnings.

To exacerbate the issue, because of the unexpectedly robust tourist numbers, rent has also increased more than expected.

LH Group is likely still tenable as a multi-year pick, though its stars have dimmed considerably compared to our initial thesis, and we have been much too early to catch the bottom.

Number three was a loser that we scaled into too aggressively, going up to the full 4% exposure, despite only having done some basic analysis. Possible remedial steps for this in the future are to:

Adjust down the 4% figure down in the future.

Set a stricter maximum allocation to side bets.

Set a tight uniform stop loss, for example a lagging 10% stop loss.

The right calls

Fortunately, Mr. Market has been merciful on our transgressions thus far, although if we had stuck to simply an equal-weighted index of our four deep-dives (returning 28%, 86%, -24%, 72% respectively), we would have seen returns exceed 40%.

GigaCloud was our first deep-dive this year, and indeed if we had taken more profits at our initial target price ($39), or tried and successfully timed the market, then we would have been much better off (perhaps this should also make it into the list of transgressions).

Still, GigaCloud has multibagging potential, and we should not be unduly concerned about its short-term performance. It will, however, be facing stiff headwinds:

Red Sea situation. With the ongoing attacks in the Red Sea, shipping costs are surging again, and we expect net margins to fall back below 10%.

Increased import tariffs. After the first debate, Trump’s odds of returning to the White House appear to have increased. Since he promised to add tariffs of 60% to imports from China, the price-competitiveness of GigaCloud’s suppliers may be affected significantly. Fortunately, GigaCloud’s Noble House acquisition and addition of Columbian, Mexican and Turkish suppliers should serve to mitigate this somewhat.

Neither fundamentally change the original thesis, though the second will have longer-term ramifications.

In October last year when GigaCloud attracted our attention, the company was deeply misunderstood, and much of the misunderstanding has continued to this day, though the macro winds are now moving against the company, at least in the short term.

As expected, Newborn Town continues to iterate on its surprise hit Alice’s Dream: Mergeland. Furthermore, there are early signs that the Chinese government may be warming back up to video games again, so the PRC market may turn out to be another growth engine for Newborn town. The situation appears to be improving beyond our initial thesis.

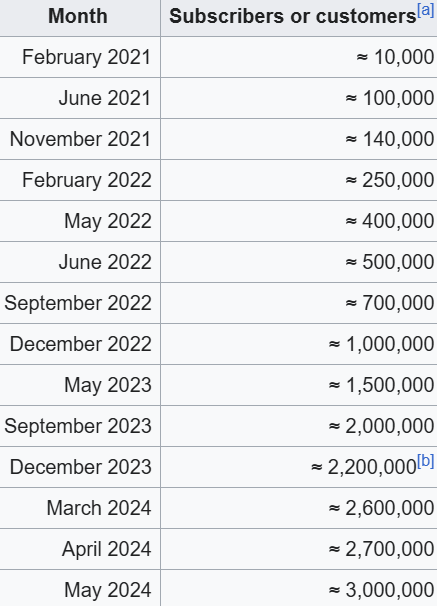

Plover Bay is performing well on the back of rapidly rising numbers of Starlink subscribers, as shown above. This clever strategy of shifting to retail users, from its founder, Alex Chan, appears to playing out exactly as intended. At this rate, Starlink may well finish 2024 with 60-90% more users than it had at the end of 2023.

It should be mentioned that Pyramids and Pagodas has an informative interview with Alex, and Asian Century Stocks also wrote up on Plover Bay.

Finally, Tencent actually represented the largest holding in the portfolio for a fair while. While global investors often prefer devote much more attention to Alibaba, we considered Tencent to be the much safer pick, with a deeper moat than the intensely competitive ecommerce sector nowadays.

At current valuations, Tencent is no longer so deeply undervalued, and we will continue to monitor if better picks come along that warrant its substitution in the portfolio.

By sector contribution alone, perhaps in the future we should give a wide berth to consumer cyclicals and real estate. However, consumer stocks have been cyclically weak this year, with both VDC and VCR underperforming SPY, though admittedly not by as much as our picks. Real estate has been even weaker, with VNQ declining nearly 7% YTD.

A last word on risk

Our allocation to China and HK-listed stocks is very high currently at over 90%, partially because they have performed strongly. The remaining portfolio has exposure to the US, Singapore and Japan, though we anticipate potentially increased allocation to US small-caps over the second half of the year.

A natural challenge may be - what about the China risk? In 2023, the US accounted for 26% of GDP (or around 15.5% in PPP terms), yet over 60% of global equities. Meanwhile, China accounted for 17% of GDP, yet only just over 8% of global equities.

While part of may be attributable to the US having more of its primary GDP contributors being publicly listed companies, over the next decade, we would still expect Chinese equities to comprise a larger share of global equities by market cap.

For this reason, over the longer term, given their current valuations, with careful due diligence and security selection, we do not believe a relatively high allocation to Chinese securities would be excessively risky.

Full disclosure: This is not a solicitation to buy or sell. We have no current business relationships with the companies mentioned in this note, and are not paid to write this piece (other than paying fellow exponents of the research). We may buy or sell securities mentioned in this piece without explicit notice.

Disclaimer: This should not be construed as investment advice. Please do your own research or consult an independent financial advisor. Alpha Exponent is not a licensed investment advisor; any assertions in these articles are the opinions of the contributors.

Congrats on the stellar results. My 2 cents: I disagree with the first Druckenmiller quote - I have not found taking a small position while doing the research (if it's looking promising) to be helpful. I find that, especially if the stock drops after I buy a small amount, it biases me far too much towards taking a substantial position in the company - I become less inclined to believe negatives about the business, or more willing to hand-wave them away, and more inclined to seek out and believe positive reports. I recently wrote a piece called 'Fighting System 1' about my struggles against my emotional desires (or 'intuitions', as we may prefer to call them) in investing. The aforementioned process sends this into overdrive. I think it's best to take your time to fully vet the company, and when you finish that process make the decision, without having any emotional investment (other than the sunk cost of the time spent researching). It's important to remember than in the short term the stock market is pretty damn random, and there's almost an equal chance of the stock going down as up between now and the end of the research process.

One other thing - I wouldn't beat yourself up too much about not selling at your price target. Assuming these are quality companies and you believe in them long-term, successful investor after investor have said the much more common and consequential errors tend to be selling too early. Cutting your flowers and watering your weeds. Especially if there have been positive developments since the PT was set, I wouldn't be too attached to it.

Well done!!