#5 July 12 '24: Gambling.com

Asymmetric GARP bet at 16x TTM P/E

We are experimenting with an easier to read format today, taking an opportunistic look at a NASDAQ-listed (we normally analyze a lot of Asian companies) smallcap, gambling.com, a founder-led digital marketing company that drives traffic to online gambling operators.

Despite the name, it is not a gambling operator, but primarily a media affiliate, and the #2 by sales and #1 by net profits for publicly listed companies in the sector.

The business currently trades at just above 16x TTM P/E, having grown revenues at over 40% CAGR for the past 5 years. Its current share price is now close to that of its 2021 IPO price of $8, although underlying revenues have quadrupled. It has grown by jumping into newly legalizing markets, both organically and via serial acquisitions.

Gambling.com’s stock price was hurt by short-term oversupply that drove competitors to losses, yet strong management and ownership of high-priority domains allowed it to grow profitably. Digitalization and regulation of the online gaming industry form secular tailwinds, although investors will be exposed to macro risks.

Although there is a lot of uncertainty, this type of business has the potential to be a compounder. While it probably will not be a 100-bagger in the next decade, it might well return 3x or 5x in 5-10 years, if management play their cards right.

We now address the questions listed below:

What problem does gambling.com solve and how does it make money?

Who’s behind the business and where does it operate?

What are the longer-term trends in the business?

What are the business segments and their scale?

Who are the competitors and what is gambling.com’s moat?

Why is the stock cheap right now and what did the market miss?

What might the fair value be?

What are the catalysts and why invest now?

What are the reasons to not invest?

What does it do and how does it make money?

Gambling.com refers online gamblers to online gambling sites, helping them to acquire new users.

It buys memorable domain names like gambling.com, bookies.com and casinos.com, typically building them up from scratch into well-known assets by creating content, reviewing and offering users comparisons across gambling services.

Ultimately its platforms play a role similar to price comparison websites in the financial services or travel sectors. Some brands owned by gambling.com are listed below.

Gambling.com monetizes their traffic via commissions:

Cost per acquisition (CPA)

Revenue sharing

Hybrid - a combination of the two

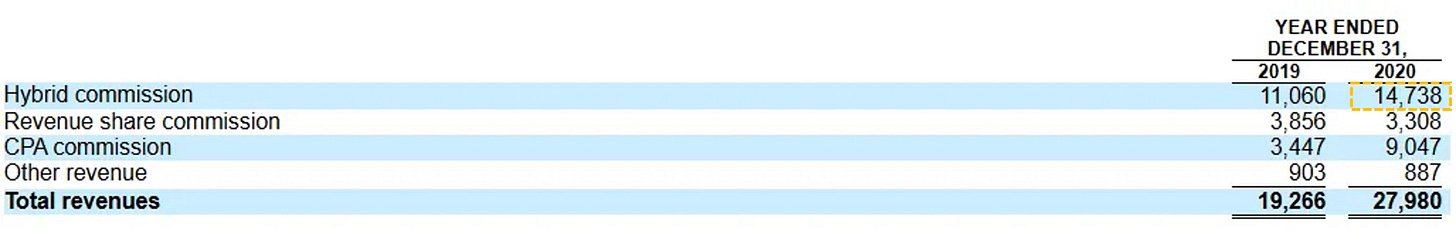

At the time of its IPO, gambling.com was mostly using hybrid commission, but by Q1 2024, CPA was the pre-eminent charge model.

This is not as negative as it may initially seem; most gamblers only play for a limited time, since they end up losing money. Some do return to gambling, but often do need to be re-acquired, especially for example when those looking to restart gambling may want to take advantage of:

Special offers that gambling companies have to entice new players.

Different odds offered by different bookies, especially for sports betting.

The second is a natural need that would not disappear, and allows the capture of lower-intensity gamblers, such as players who place bets on sporting events.

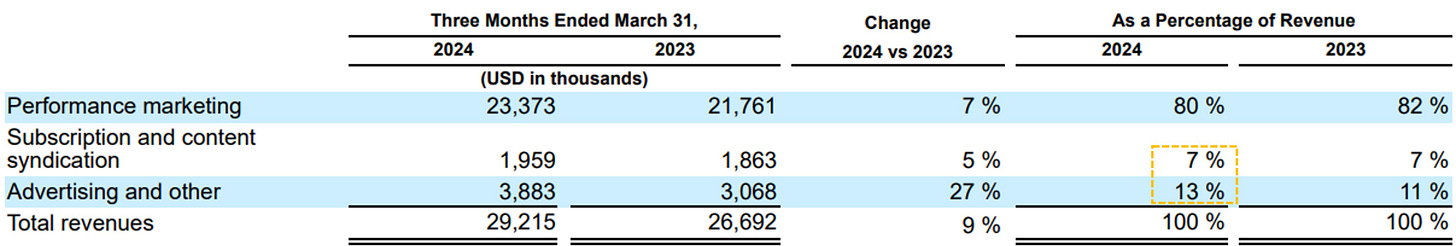

Gambling.com have also broadened beyond performance marketing, into content syndication and general advertising, which now constitute 1/5 of revenues.

Who’s behind the business and where does it operate?

In a twist of fate, the management team is largely American, yet at the time of its 2021 IPO, gambling.com’s primary market was the UK and Ireland. What may seem to be a mere factoid is actually a core competitive advantage.

Both founders, Charles and Kevin, are from Charlotte, North Carolina, and attended the University of North Carolina at Chapel Hill together (interestingly, the strategy VP of a competitor, Catena Media, also may have caught the gambling bug there). As they were graduating in 2006, they wanted to start an online gambling company.

Unfortunately for them, in October 2006, Congress passed a law named the Unlawful Internet Gambling Enforcement Act (UIGEA), which made it illegal for betting businesses to take payments from Americans for gambling.

Up until then online gambling platforms were operating in a legal grey zone; they tended to be offshore, and many were based in the UK, such as PartyPoker.

Yet immediately the chilling effect was felt as David Carruthers, the CEO of an offshore operator called BetOnSports, was arrested in Dallas on a layover. Almost overnight, major gambling platforms began to ban Americans.

As a result, they decided to head to Europe, where regulations for online gambling were already in place. When they found it would need too much capital to obtain an operating license, they instead started in affiliate marketing.

They initially built the business up in the UK, and then Ireland. Mark Blandford, whom Charles credited as his mentor, and a pioneer in online gambling, became the largest shareholder and former chairman along the way with over 1/4 of the outstanding shares (Charles is the second biggest shareholder with just over 1/8).

Mark, an old-school British bookie, ran his own offline ops for over a decade, before spotting the potential for online gambling in the mid-nineties, going on to found Sportingbet in 1998 and listing on the LSE AIM in 2001. He is very influential in the sector, investing in and advising multiple gaming-related businesses.

While Charles found his way to Monaco a few years later, Kevin did a stint in Dublin, then New York, and finally moved back to their hometown of Charlotte.

This was made possible due to the 2018 repeal of the Professional and Amateur Sports Protection Act (PASPA), which previously outlawed sports betting. The repeal allowed states to individually determine if they wanted to legalize sports betting or not.

However, online casinos, or iGaming, is actually the larger and more lucrative part of online gambling. Technically it is still affected by UIGEA, yet the overall direction appears to be for liberalization, and devolution of regulations to the state level.

Time for a quick poll!

What are the longer-term trends in the business?

Two major trends are changing the landscape of the sector:

Regulation. Even after UIGEA, offshore gambling continued; US residents simply used unregulated payment methods like crypto. Legalizing gambling means that states could collect tax revenues, and better protect consumers. The more states that legalize gambling, the greater the addressable market.

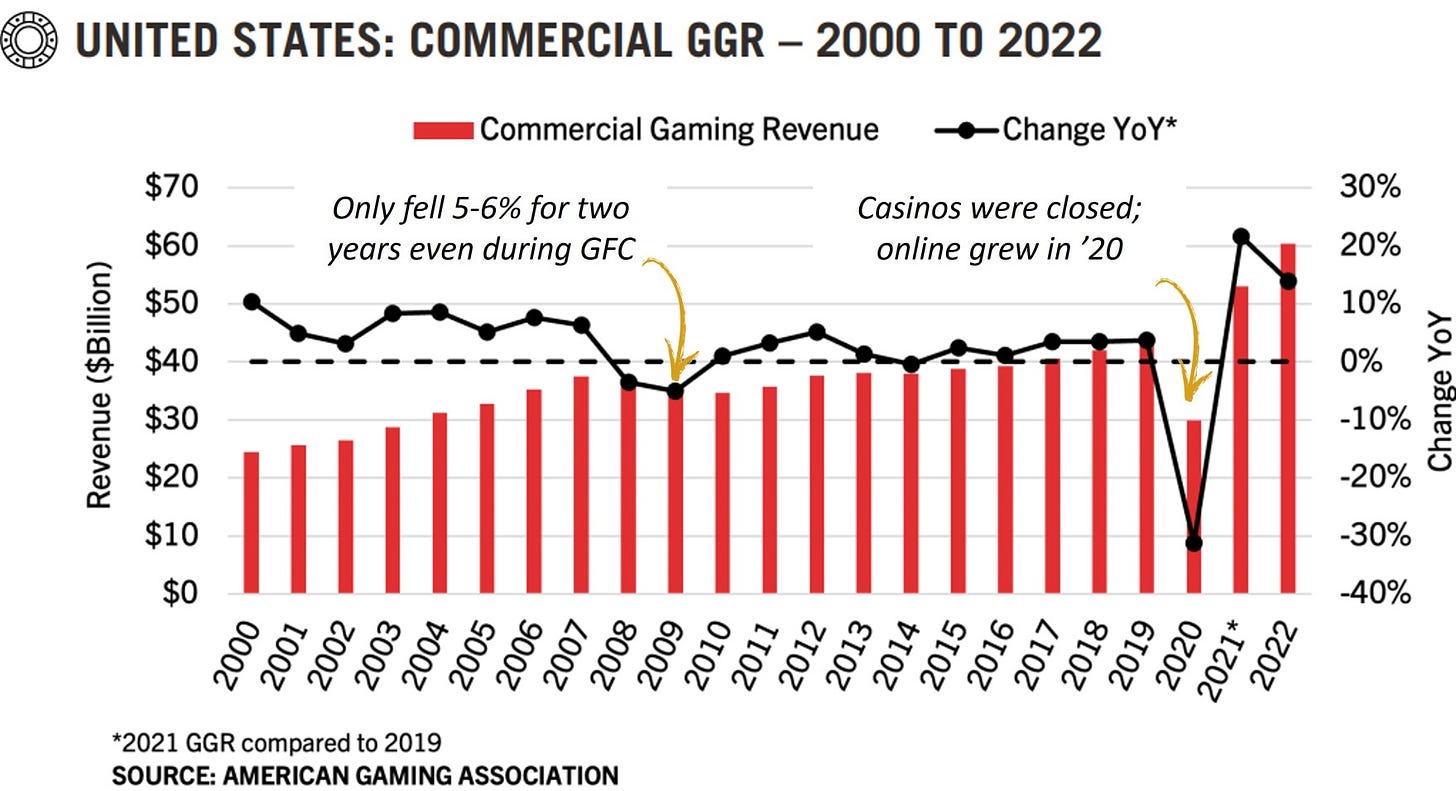

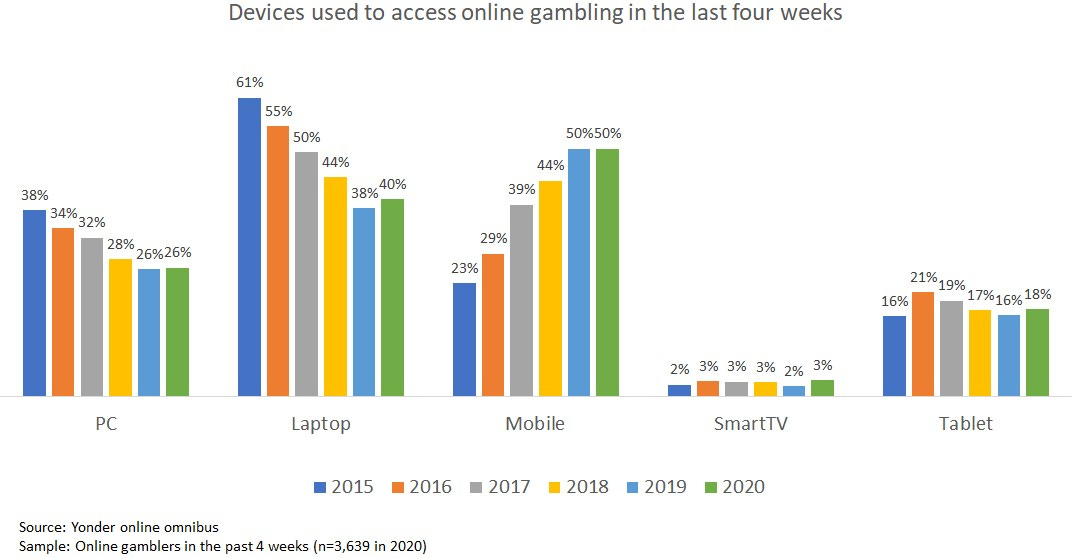

Digitalization of casinos. Partially as a result of regulations, the US has been more casino-oriented versus the more digital-centric European market. However, digitalization has been an inexorable trend, powered forward by regulation, and accelerated by the pandemic.

According to the AMA, online represents ~10% of GGR in the US, but for states in which online sportsbooks and iGaming are already legal, this would be around 40%.

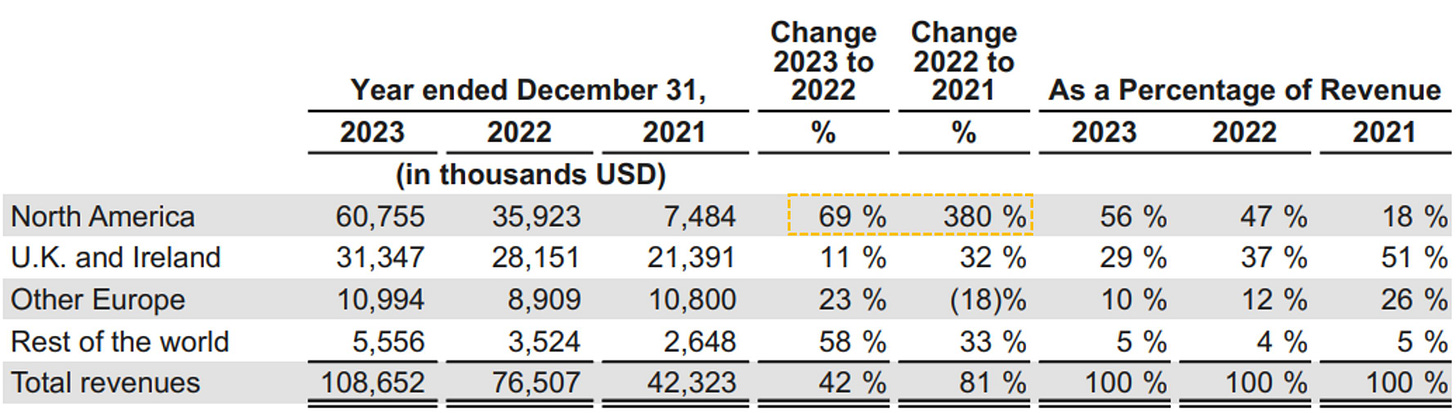

Management has been very agile and quick to leap into new growth opportunities, especially across markets. At IPO the UK and Ireland still constituted gambling.com’s largest market in 2020, but by 2023, North America was the largest.

As shown above, North America acted as the key growth driver from 2020 to 2023, while the RoW accelerated from 2022 to 2023. In 2024, Other Europe has been picking up the slack as shown below.

Gambling.com also used inorganic means to boost growth after IPO with the acquisitions of RotoWire for the US in 2021, which added about $7 million in run-rate revenues, and Bonusfinder for Canada in 2022, which added $10-13 million.

However, given that revenues grew from $28 million in 2020 to over $108 million in 2023, at least 80% of the growth works out to be organic.

What are the business segments and their scale?

According to Statista data below, the global online GGR is already above $100 billion, and expected to grow at around 6% CAGR until 2029.

The biggest online gambling markets are the US, the UK each with over $10 billion, followed by Australia at around $6-7 billion, and then Italy and France at below $5 billion.

The segments within online gambling are driven by regulation.

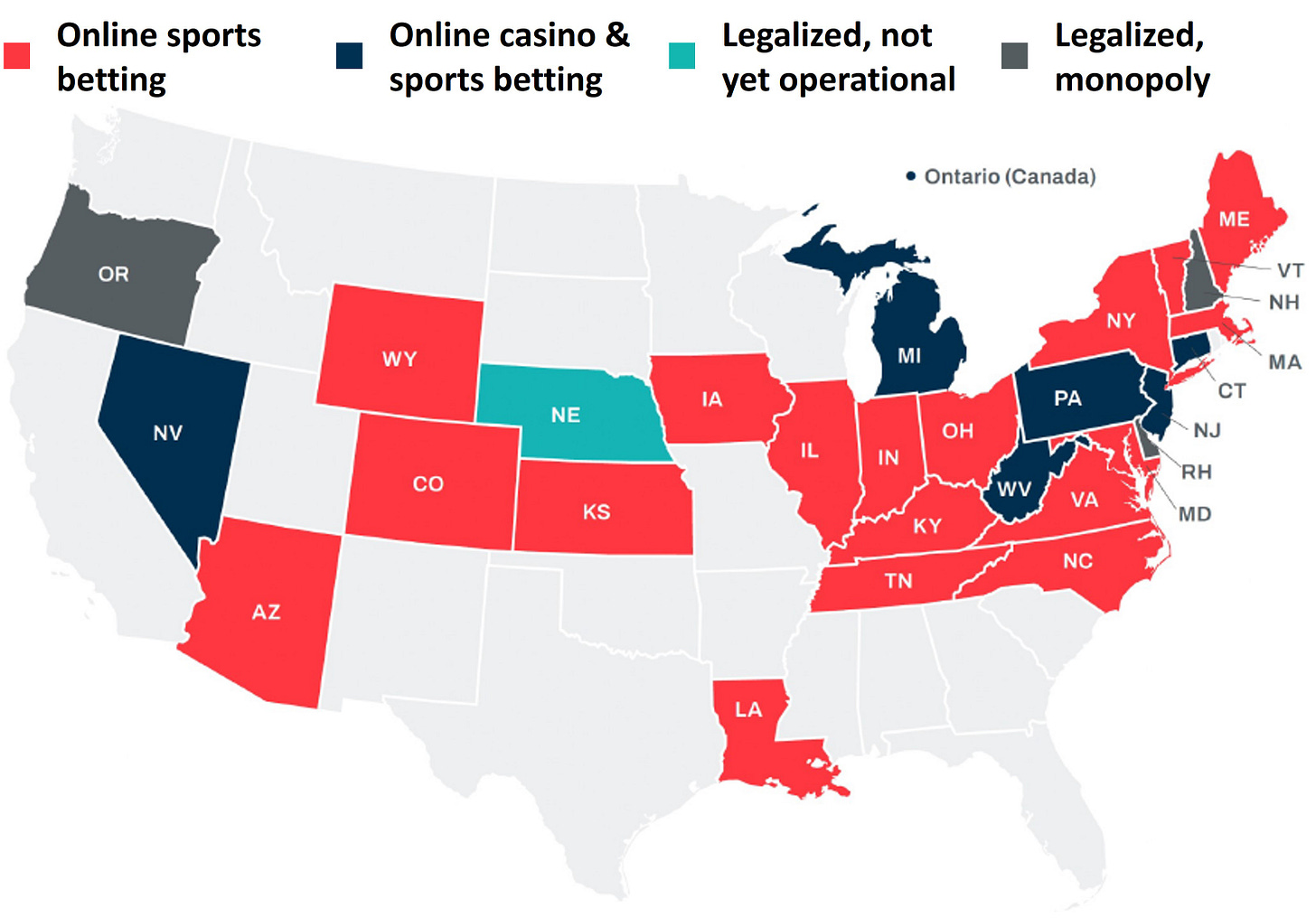

Sports betting. Smaller but already legalized in 38/50 states as of 2024.

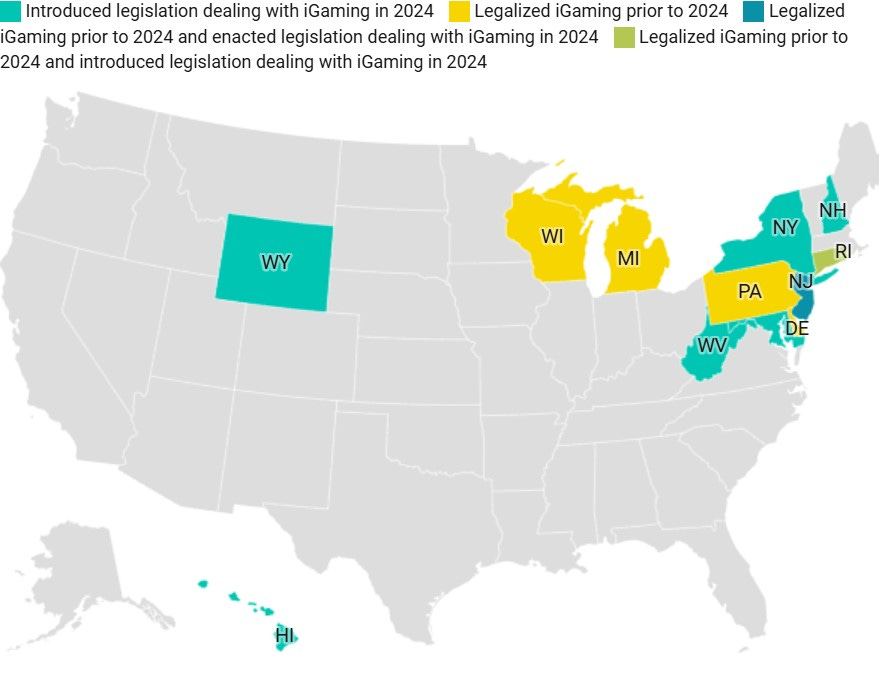

iGaming. Larger and more lucrative, but yet to be legalized in most states; only 7/50 states have already legalized iGaming (Rhode Island became the 7th state in early 2024, not counting Nevada where only online Poker is legal).

Other. Sometimes there are specific regulations for popular games like Bingo, horse-racing and poker, and online lotteries can form yet another segment.

Online sports betting in the US revenue has grown to over $10 billion in 2023.

Meanwhile in the same year regulated iGaming revenue in the US has exceeded $6 billion. Note from below how the market grows in an almost stepwise manner as new states legalize iGaming, with for example Michigan adding a billion in 2021.

Though future growth from legalization will not be as rapid as during the pandemic, each additional state to legalize grows the addressable market. Since over 80% of states have yet to legalize iGaming, this leaves considerable headroom in the US.

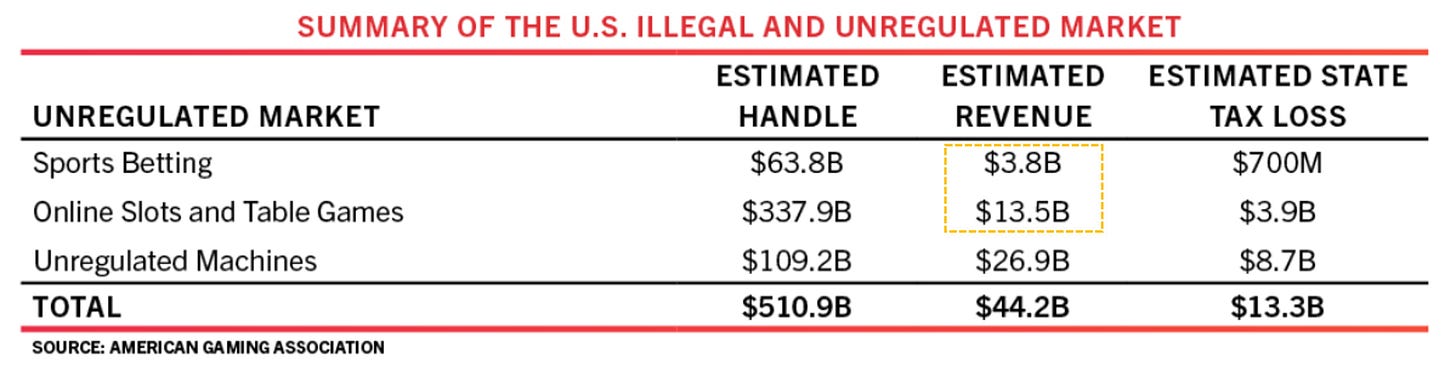

The American Gaming Association estimated of the illegal and unregulated US sports betting and iGaming market to be over $16 billion, as shown below. While by nature this is a very rough exercise, this also shows significant whitespace for growth.

A word on terminology: “handle”, also known as “total turnover”, is the sum of all wagers paid in by players. “Gross gaming revenue (GGR)”, or simply “revenue”, refers to the handle less the winnings paid out, so what the house stands to earn, pre-tax.

Shifting over to Europe, the UK is the world’s second largest gambling market after the US, Australia is third, followed by Italy. The map below shows that most European nations have already regulated online gambling to some extent.

Gambling.com operates in both the Casino (iGaming) and Sports betting segments, with the Casino segment now contributing over 2/3 of revenues.

Who are the competitors and what is gambling.com’s moat?

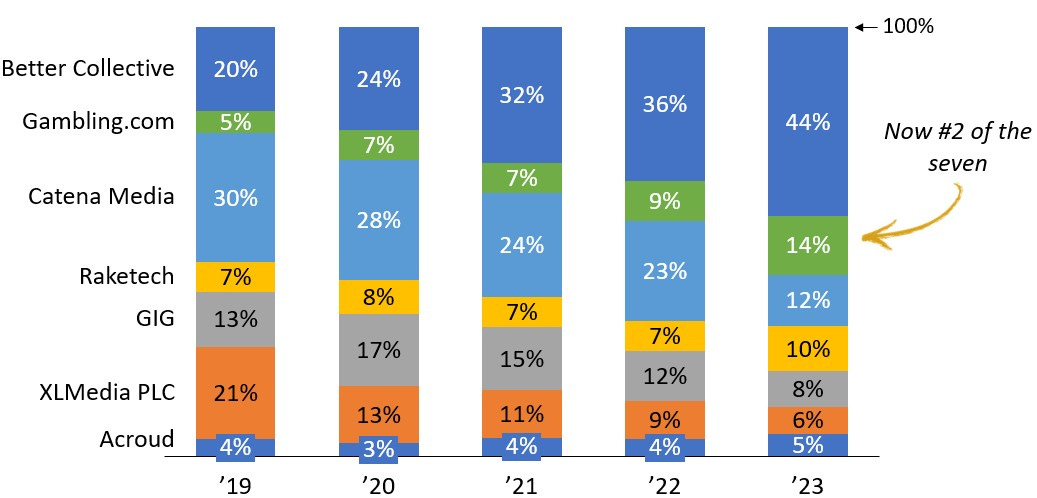

Sector concentration is low and difficult to estimate; some players are still not listed, and there are overlaps with other affiliate marketing verticals, as well as media buying vendors and betting operators. Instead, we look at how the share of revenues across seven major players have evolved as below.

Only five years ago, Gambling.com would have been #6 of the seven. Now it is #2, and we are optimistic about the prospects, especially given their strategic direction, which we shall go into later. The company has two important yet easily underestimated advantages that are intangible and difficult to quantify.

American management, American listing. The US is the largest gambling market in the world, and will likely contribute the most growth in the next decade, with increasing legalization and digitalization, despite an apparent oversaturation in the short-term (more on this later).

Highlight: Management’s experience with sophisticated UK online operations gives them the edge versus purely US teams, while their understanding of US gaming culture and differences in user habits forms an advantage against European teams, allowing them to quickly make the right strategic calls ahead of competitors.

Most competitors, apart from GAN, are listed in Europe, especially on the Nasdaq Stockholm exchange. Gambling.com’s US listing immediately gave it more capital to grow, but also increased visibility and credibility for the longer term.

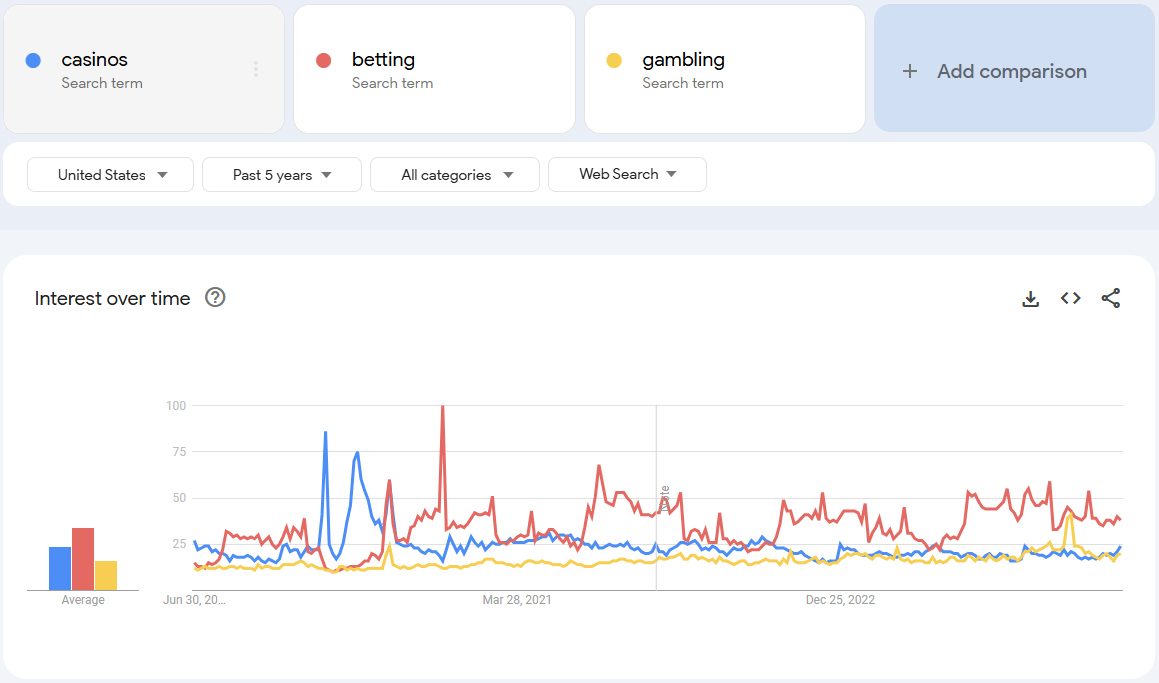

Memorable domains. Apart from the advantage in mindshare, because its domains like gambling.com, casinos.com and FreeBets.com contain some of the top natural keyword searches, as can be seen below.

Gambling.com owns also many state gambling domains (like BetCarolina.com, BetKentucky.com), etc., which also receive a spike in traffic as each state regulates.

Highlight: The value of these pieces of virtual real estate is easily overlooked, yet they give gambling.com superior unit economics to competitors who do not have comparable assets, thanks to the “free” SEO traffic.

It should be noted that owning a nice domain name alone is insufficient, multiple private companies such as Game Lounge (betting.com) and the eponymous Casino.org all have memorable domains, but are considerably smaller.

Why is the stock cheap right now and what did the market miss?

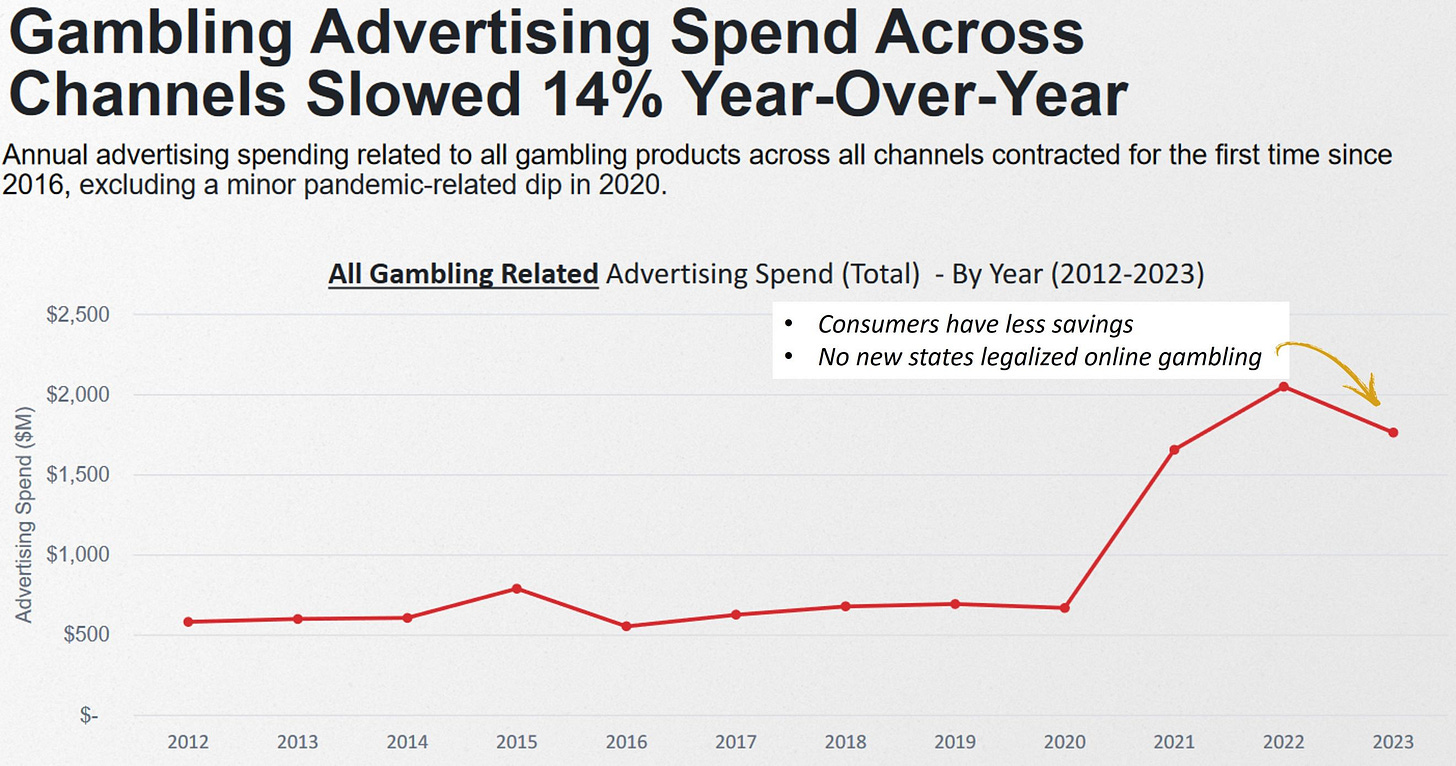

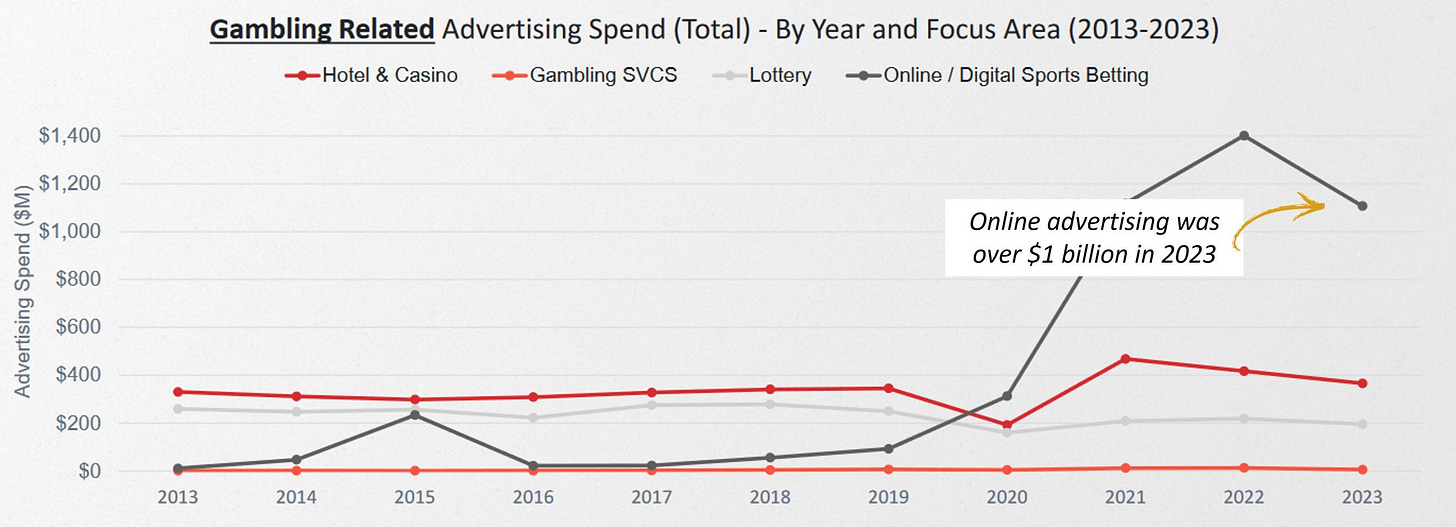

The stock is cheap primarily because of low investor confidence; the sector was struggling in the US due to saturation. On the demand side, gambling operators were cutting back on ad spend.

On the supply side, however, many players had rushed into the space, especially after the stimulus checks in 2021 gave consumers lots of cash. Online traffic was getting expensive, and competition was rising, even as clients were cutting back - all this hit the margins of sector players hard in 2022.

Highlight: By 2023, margins for Gaming Innovation Group (GIG) and Gambling.com have recovered somewhat, even as Catena and XLMedia deteriorated further. While GIG effectively sacrificed share to preserve margins, Gambling.com continued to grow.

Going forward, Better Collective may pursue a high-volume, low-margin strategy, even as gambling.com pursues a more targeted and higher margin strategy, with a differentiated focus on iGaming.

A share resale in Jun 2023 had dampened investor enthusiasm and may have created price anchoring. Although no shares were newly issued, Mark sold nearly 1/4 of his shares at $9.25, below the then market price of $11.23. This is negative, because:

Largest shareholder selling may indicate lack of confidence

Selling for below-market may imply the market price was deemed too rich

Mark still has remaining shares that he may sell at some point

Finally, macro headwinds also played a role in the pricing; general weakness in small caps in US equities, and their sensitivity to rates has caused prices to be depressed - contrary to market hopes, the Fed has not yet cut rates.

However, the market has missed some important cues on Gambling.com. In 2023 it in fact became the top listed player by net profits in the sector, even ahead of the bigger Better Collective. This is despite the sector being loss-making collectively.

Indeed, in Q1 2024, gambling.com’s net margins have normalized to 25%, the same as the prior year, as shown below, though year-on-year growth has slowed down to 9%, which likely further weighed on investor sentiment (2023 saw 36% YoY).

However, this was arguably the best result of the set; quarterly earnings for competitors generally deteriorated year-on-year. GIG did grow revenues, but saw flat profits - and also plan to split out the platform and sportsbook business.

Being ahead of the game, avoiding overly fierce competition, and doing the right M&A deals are all key prerequisites to being profitable in this sector. So far, gambling.com appears to have made the right calls.

As can be seen below, most competitors are increasing presence in the already saturated US market, whereas both Better Collective and gambling.com are betting on LatAm and Europe respectively.

In our view, Gambling.com and Better Collective appear to be comparatively well-positioned for the coming year.

This strategy is reminiscent of how gambling.com focused on online casinos even as competitors focused on the larger sportsbook businesses - management appears to have a very good sense of where there would be relatively less competition.

What might the fair value be?

We perform a simplified DCF for now and provide the full three-statement model next week. We assume gambling.com’s earnings to grow in-line with global online gambling revenues at 6%, and use a discount rate of 5%, a little above the 10-year treasury yield.

Assuming multiples remain constant, it would only take a forward 5-year CAGR of 12% for the stock to be a two-bagger.

Sense check by reverse DCF. At current prices, using the above assumptions, the implied forward 5-year CAGR would come to below 0%. This appears to be overly pessimistic, unless there is a deep recession, or serious issues occur to gambling.com.

Sense check against prices. Again staying with the assumptions, we see that the current price of Better Collective backs out to 18% CAGR over the same period, and 8% for GIG. This implies there may be potential for some type of long-short pairs play.

Sense check versus multiples. More generally, within the comparison set, gambling.com’s EV/Sales and P/E multiples appear to be less than half of Better Collective, and less than even GIG.

For example, using the EV/Sales comparison against GIG implies that gambling.com would be over 40% undervalued.

Share buybacks earlier this year at $9.10 also implies that management also believes the stock price to be undervalued - and is now around 10% lower than that.

Sense check versus addressable market. This is to make sure we are being realistic versus the total opportunity.

The US online gambling market will likely be around $30-40 billion by 2029.

5-10% of GGR would go to online advertising, implying a market size of conservatively perhaps $1.5-2.5 billion for online advertising.

A doubling of revenues to $200 million would work out to be 10% of the US online advertising market, or 5% of the US market, and an equivalent contribution elsewhere.

If they can eventually hit $800 million sales (need to take 20% of US market and obtain similar sales in the RoW), 10-15% net margins, and a 12x P/E multiple, the implied valuation would be $1-1.5 billion. Those numbers illustrate the 3x to 5x dream case.

What are the catalysts and why invest now?

Recently in May 2024, Google reduced its weighting for sponsored articles, such as those that gambling.com would produce for media partners. Consequently, the company cut guidance for the year by $11 million and adjusted EBITDA by $4 million.

Although this would still imply sales and EBITDA growth of 11% and 22% respectively for 2024, the stock price dropped further. On the earnings call, Charles described the change in Google’s algo as a “tailwind”, because while it lowered income from media deals, it also improved visibility of gambling.com’s company-owned domains.

Because this means that revenue will no longer have to be shared (and gambling operators will have to increase reliance on affiliates over traditional media), we agree the latter will likely improve unit economics in the long run, even though short-term income would suffer.

Competitors were also hit; Catena Media is anticipating Q2 revenues decline 20% YoY, Better Collective mentioned uncertainty, though both anticipated the second half to improve as they adjust to the Google changes.

Given the Canada deal and legislation moving through California, this is also likely to be a longer-term trend, as legacy media will increasingly try to charge Google, which appears to be de-emphasizing links to them in response (though the 2024 change was cast as a site reputation abuse update).

Apart from this, there are other catalysts.

Rate cuts and acquisition of FreeBets.com. There may be rate cuts in both the US, and continued cuts in Europe - gambling.com’s bet to acquired FreeBets and related European assets from XLMedia is well-positioned to take advantage, even as most competitors double down on the already intensely competitive US market.

Legalization in more states. Management guidance is that North Carolina is expected to be the only launch in 2024, having legalized sports betting (gambling.com did not launch in Rhode Island - Bally has a monopoly there). Any progress towards legalization in more states would provide further upside.

The diagram below shows the states in which iGaming is legal or legalizing; those will bring the biggest spikes since iGaming is a bigger business for gambling.com, and fewer states have already legalized.

Gambling.com already owns many state-specific websites for gambling, which will receive traffic spikes once the legalization process starts.

What are the reasons to not invest?

Regulatory risk. At the federal level, there were efforts to ban or otherwise restrict online advertising for gambling, e.g., the Betting on Our Future Act (which did not pass in 2023), with comparable efforts at the state level in Louisiana and Kansas. The new 2024 version attempts to restrict use of consumer data for targeted advertising.

Sensitivity to macro environment. Although it is commonly cited that the gambling industry is very resilient against recessions, the stock prices of companies involved in the sector are much less so.

Reliance on Google. As we saw before, changes in Google’s algorithms at times introduce volatility into margins. If Google were to be disrupted, gambling.com’s business would similarly be disrupted.

Shift to mobile. Related to the above, gaming is shifting slowly to mobile, where native apps dominate, which means users go directly to the apps more and search less.

Industry consolidation. As the downstream gambling industry consolidates, the competition for traffic would also lessen, reducing the bargaining power for marketing affiliates like gambling.com.

Long-distance founder. It often signifies a lack of commitment when the original founder is based apart from the rest of the team, and also apart from the clients.

However, in this particular instance, this working arrangement has not prevented gambling.com from delivering results - Charles has lived in Monaco for over a decade, while his team is based elsewhere, so this setup appears to work well for them.

Full disclosure: This is not a solicitation to buy or sell. We have no current business relationships with the companies mentioned in this note, and are not paid to write this piece (other than paying fellow exponents of the research). We may buy or sell securities mentioned in this piece without explicit notice.

Disclaimer: This should not be construed as investment advice. Please do your own research or consult an independent financial advisor. Alpha Exponent is not a licensed investment advisor; any assertions in these articles are the opinions of the contributors.

Edit: Clarified wording in parts